Recently, Western Sierra Resource Corp has been one of the most talked-about OTC stocks on the market. On June 22nd, the company announced they were in talks to acquire 70% common share ownership of SSMG.

Today, I will outline 5 of the most important things to know about Western Sierra Resource Corporation.

1. Recent History

Western Sierra Resource Corporation was founded in 1907 and has historically been a gold and silver mining company. They continue to own several different precious metal reserves in Arizona. The company is also involved in agricultural production, development of green energy technology, stock watering and open space maintenance.

Currently, Western Sierra Resource is recognized by the SEC as a multifaceted resource company and revenue producer focused on expanding its water rights assets. However, the most recent filing they have with the SEC is from April of 2009. So, it is a little difficult to find relevant information on the company. This means, understanding Western Sierra’s financial standing can prove to be relatively difficult at this time.

Lastly, even their website has been under construction for the past week. So, those looking for some quick information on the company may struggle to do so.

2. 2nd Most Recent Headline

Upon first looking into the company, I would have thought it was just another hemp stock finding a way to get their name in the news. Luckily, I don’t believe this is true.

In February of 2021, WSRC consolidated its assets, retired some outstanding debt, and opened new access for funding new projects. All of this was allowed by collateralizing its water infrastructure assets in Colorado. (The story may be starting to add up now, huh?) This step was taken so that Western Sierra Resource Corporation could access capital to retire its existing debt obligations and find the means to utilize its strategic water infrastructure assets. To put it simply, WSRC seems to be diversifying their business with a 25-year project, known as the HAIZ project.

This project’s core objective is to develop “green” and “affordable” homes in a Planned Unit Development (“PUD”) utilizing hemp-based construction materials. This will include development of large-scale irrigation and cultivation of industrial hemp, and the manufacture of hemp-based construction products and textiles. For more information on this product, I would point you to the company’s main website. However, this project seems to be only a blip on the radar for the leaders of Western Sierra Resource Corp.

3. Most Recent Acquisition

News of Western Sierra Resource Corporation’s most recent acquisition negotiation began on June 22nd. There have been lots of large projected revenues thrown about. I would like to share how these numbers were found, and some other figures that the public should know.

I prefer a bullet-point thread to show how this could all work out.

- WSRC is looking to acquire 70% of Silver State Mining Group’s (SSMG) common stock.

- SSMG owns 49% of the Sage Hen mining claims in Nevada, totaling 640 acres.

- This means that WSRC would own about 34% of the total mining claims from Sage Hen.

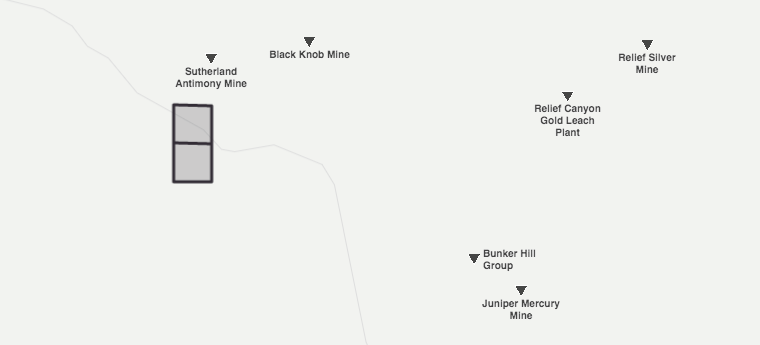

- The Sage Hen claims are located adjacent to the Relief Canyon Mine in the Oreana Tend.

- The Relief Canyon has shown the ability to mine gold, silver, platinum, palladium, and rhodium.

The screen shot above shows the site of Sage Hen. It’s located southeast of Colado, Nevada, on Coal Canyon Road. Many of the mines located near the Sage Hen location are also in prospect development phases. However, Relief Canyon shows that the primary minerals mined are gold and silver at their location.

Recent reports show the companies plan on starting out mining a total of 100 tons per day. Then moving to 1,100 tons per day at a future point. This is where the somewhat outlandish estimates come through. If the two companies (WSRC and SSMG) are able to pull out 1,100 tons of material per day, then they project an annual net income of $3.2 billion. Just for kicks, if the companies only pull out 100 tons per day, then projected annual net income would be $269 million. If Western Sierra Resource Corporation’s negotiation talks are approved, this would mean their annual income could jump between $91 million and $1.08 billion.

Now, that is obviously quite the wide range. Also, there are many estimates and projections that all of this is riding on.

These estimates presume that due to the performance of the Relief Canyon Mine, the Sage Hen region will be able to produce the same output. By now, companies do have the capability to make accurate projections of underground deposits, however, we can not be 100% sure. Moreover, it would be interesting to see if WSRC has experience in the past of running an operation of equal size. I would be sure to check this on their main website, once it is back up and running. Last but not least, as of now, we are unable to accurately predict the percentage of deposits of each material at the Sage Hen mining location. However, the scale of the project is something you would expect a mining company that began in 1907 to handle.

Summary

At the end of the day, the success of a prospecting mining company can be very difficult to predict. With a large scale production still needing to get underway, there are plenty of challenges and unknowns the company will face. However, as a numbers guy, this is what I see. (Assuming all projected numbers stated by Western Sierra Resource Corporation are true.) As of June 27th, WSRC’s trading price landed its market cap just below $84 million.

With this project, if they are able to meet 50% of their maximum mining goal(550 tons per day), they would project an annual income of $1.479 billion. With WSRC owning about 34% of the mining claims at Sage Hen, that would land them with approximately $503 million of annual income from this project. Additionally, there are many other reports showing that Western Sierra Resource Corp owns many other projects. This could all add to an even healthier balance sheet in the long-term.

But, those are a lot of “if”s.

If you haven’t been able to browse my website, follow the following link to the Start Here page. In the upcoming weeks, I plan to include some of my favorite resources and courses I have enjoyed learning from in the past. Last, if anyone has any suggestions, questions, or concerns please feel free to reach out to me through the link provided here. Come back next week for another top penny stocks list.

WSRC Stock Price at time of Publication: $0.22

WSRC Stock Price as of July 8th: $0.18

Do Your Own Research

*Disclaimer: The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. It is only intended to provide education about the financial industry.

Sources:

https://sec.report/Ticker/WSRC